When incurred, they create an accrued expense account in your balance sheet that is shown as their own line item. These show up as a current liability on your company’s balance sheet.

Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. DateAccountNotesDebitCreditX/XX/XXXXAccrued LiabilityXCashXWhen you reverse the original entry to show that you paid the expense, you must also remove it from the balance sheet. And because you paid it, your income statement should show a decrease in cash. DateAccountNotesDebitCreditX/XX/XXXXExpenseXAccrued LiabilityXWhat happens when you make these entries?

Example Of Accrued Expenses Payable

When the salaries are paid on 4 January, the cash account is credited for the full week’s salaries. Salaries payable is debited for the salaries recognized in the prior period, while salaries expense is debited for the current period’s salaries. The journal entry for accrued interest expenses corresponds to the entry for accrued interest revenue. However, in this case, a payable and an expense are recorded instead of a receivable and revenue. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred in one accounting period that will be paid in subsequent periods. Debit balances related to accrued revenue are recorded on the balance sheet, while the revenue change appears in the income statement. Accrued expenses are to be written down on the liability side of the balance sheet.

As an organization collects expenses, that portion of unpaid bills is increasing. The accrual concept of accounting states that the inflows and outflows should be recorded when they occur regardless of whether actual cash is paid or not.

Accrued Liabilities Explained

An adjusting entry to accrue expenses is necessary when there are unrecorded expenses and liabilities that apply to a given accounting period. These expenses may include wages for work performed in the current accounting period but not paid until the following accounting period and also the accumulation of interest on notes payable and other debts. The Business Office currently reviews all items submitted for payment. If an adjustment is warranted, the Business Office will post an adjusting journal entry to ensure the payment is expensed to the proper fiscal year.

It acknowledges revenue and payments that occur during a particular period of time even though no cash transaction is involved. This could result in the overstatement or understatement of the total balance. Examples of accrued expenses include monthly costs of rent and utilities, employee wages, and certain products and services if you are using them but have not yet been billed for them. If you use the cash method of accounting, you will have entered none of these expenses into your accounting software. This keeps things simple, but it also suggests you have an extra $3,350 available—which you might spend without realizing it’s already been spent. If you use the accrual accounting method, you will have accounted for all those expenses before they are paid out. If you’re a large U.S. publicly traded corporation, you’re required to use the accrual accounting method and show your accrued expenses at all times.

The proceeds are also an accrued income on the balance sheet for the delivery fiscal year, but not for the next fiscal year when cash is received. Common accrued expenses are utilities, salaries and wages, and janitorial services. These expenses are routine but may not be billed until after the accounting period closes. Since the company knows it has an obligation to pay, it will record an accrual to acknowledge the debt. Consider a company that pays its employees’ salaries on the following month’s first day for the services they received in the prior month. Someone who worked in the company for all of June will be paid in July. At the end of the year, if the company’s income statement only recognizes the salary payment that has been made, the accrued expenses from the employee services for December will be omitted.

- Accrued AB Loan Interest With respect to any AB Modified Loan and any date of determination, the accrued and unpaid interest that remains unpaid with respect to the junior note of such AB Modified Loan.

- Typically, when a business acquires items or services from a vendor, they are allowed a period in which to cover the payment for those items or services.

- If companies received cash payments for all revenues at the same time when they were earned, and made cash payments for all expenses at the time when they were incurred, there wouldn’t be a need for accruals.

- Some record these types of expenses in the accounting software their company already uses.

- Accounts payable is a metric that some people used as a measure to balance the acquisition of goods on credit.

- This is because these expenses often have to be estimated and adjusted to reflect the exact amount once bills have been received.

- The proceeds are also an accrued income on the balance sheet for the delivery fiscal year, but not for the next fiscal year when cash is received.

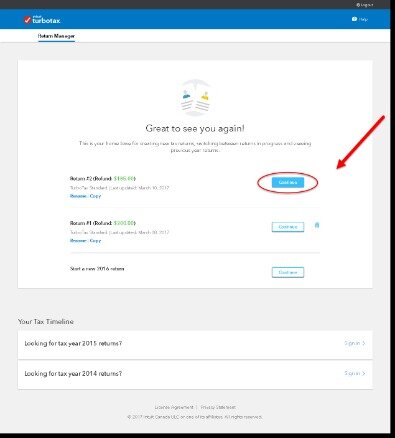

These short-term or current liabilities can be found on your company’s balance sheet and general ledger. Depending on your accounting system and accountant, they might also be called accrued liabilities or spontaneous liabilities. You have options in how to record your business’s accrued expenses. Some record these types of expenses in the accounting software their company already uses.

Accrued Expenses Example Calculation

Accrual accounting uses accruals to recognize revenues that have been earned but not paid and to recognize debts that have been incurred but not invoiced. Accrued expenses are the expenses that an organization has already occurred in the past that will be due in the future accounting period. Payables are those that still need to be paid while expenses are those that have already been paid. When a company accrues expenses, this means that its portion of unpaid bills is increasing. Following the accrual method of accounting, expenses are recognized when they are incurred, not necessarily when they are paid.

- Notwithstanding the foregoing or anything to the contrary herein, Company Expenses shall not include any HighCape Expenses.

- Then, you will credit your expense account with the payment that you made.

- However, during this period, Joe is not receiving his bonuses materially, as would be the case with cash received at the time of the transaction.

- Accrued expenses are costs to your business for which you have not yet been invoiced and which you have not yet paid.

- “Accounts payable” refers to an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers.

For example, ABC marketing agency signs up for a marketing automation software, ‘Yoohoo’, that’s billed quarterly at $600 for a three-user package. Twenty days into the subscription period, the agency realizes that they need two more users to access the software. Furthermore, the agency also requested Yoohoo to provide an exclusive training session. Examples of Prepaid ExpensesAdvance travel payments for trips to be taken after July 1. They even posted mundane administrative materials, including expense accounts and personnel memos. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services.

See For Yourself How Easy Our Accounting Software Is To Use!

As a result, accrued expenses can sometimes be an estimated amount of what’s owed, which is adjusted later to the exact amount, once the invoice has been received. A revenue accrual does not need to be made if an accounts receivable entry has already been recorded. If cash is received on or after July 1 for revenue that was not recorded in the current fiscal year, please process a revenue accrual. An expense accrual should be made for goods or services provided where the expenditure has not been recorded. One reason that an accrued expense will accumulate is because some small-business owners or accountants simply fail to account for these accrued liabilities. When companies fail to anticipate these accrued expenses, they can build up and cause the company’s budget to be shorted by too little available cash when it comes time to pay suppliers. Accrual accounting takes into account every transaction, even the credit expenses that are an estimated amount.

- SaaS businesses sell pre-paid subscriptions with services that are rendered over time and hence require the use of the accrual basis of accounting.

- The best financial reporting method for your business is the one you most consistently use.

- Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs versus when payment is received or made.

- Accrued expense is a liability whose timing or amount is uncertain by virtue of the fact that an invoice has not yet been received.

- Twenty days into the subscription period, the agency realizes that they need two more users to access the software.

Accounts payable are listed on the balance sheet, whereas accrued expenses are listed on the income statement. There are some accounting to record accrued expenses on a business’s balance sheet that there is no standard that requires it to be there. Accrued expenses most often translate to a company’s operating expenses, but accounts payable does not. Accounts payable is a metric that some people used as a measure to balance the acquisition of goods on credit. Accrued expenses are more concerned with the payment for the products and services that keep the business running. An accrual, or accrued expense, is a means of recording an expense that was incurred in one accounting period but not paid until a future accounting period. Accruals differ from Accounts Payable transactions in that an invoice is usually not yet received and entered into the system before the year end.

If you’re a small private business, however, GAAP doesn’t apply, so you can choose between showing or not showing your accrued expenses in your financial records. Accrued expenses are costs you already have incurred but for which you have not yet paid or documented payment. Accrued expenses are part of virtually all business and personal budgets, and may be accounted for in different ways, depending on the accounting system you use. AccountDebitCreditPrepaid Expenses1,200Cash1,200Prepaid expenses are an asset on your balance sheet as it reflects a future value—multiple months of a social media management tool—for your business. Then every month, you need to make an adjustment to reflect the monthly expense of the subscription. It doesn’t feel right having a one-time $1,200 payout impact the income statement of one month. You’re actually prepaying for the full twelve months of service, and your accounting can reflect that.

Accrual Accounting Vs Cash Basis Accounting: What’s The Difference?

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. The salaries for the next 4 days of the week, or $1,200, are the expense of the next year, 2018.

Therefore, it’s something that must be carefully tracked to ensure a company’s balance sheet is accurate. This involves closely tracking accumulated payments, either as accrued expenses or accounts payable. Similarly, the salesperson who sold the product earned a commission at the moment of sale .

During her career, Lisa launched her own small writing and instructional design business and writes about business for major web publishers such as Harvard Business Publishing. As a teacher and instructional designer, Lisa has created business-related tutorials and interactive courses for universities, educational publishers, and students and adults entering the business world. For 2020, the company asks Ernst & Young to audit the company’s results and verify that everything is reported accurately and in a proper manner. When it completes the audit, Ernst & Young sends an invoice of $32,500 to Company X with an analysis of the actual hours spent on the auditing.

Credit $31,000 to “Wages Payable” (this would show up under “Short Term Liabilities” on the balance sheet). Accrued AB Loan Interest With respect to any AB Modified Loan and any date of determination, the accrued and unpaid interest that remains unpaid with respect to the junior note of such AB Modified Loan. Permitted Payments means payments by the Distributor to Qualified Recipients as permitted by this Plan. Accrued Servicing Fees based upon the Scheduled Principal Balance of the Mortgage Loan as calculated on a monthly basis.

An accrued liability is an expense that a firm has incurred but has not covered yet. This is a key element of theaccrual method of accounting, which recordsexpenseswhen they are owed and revenues when they are earned. If you use cash accounting, you won’t record accrued expenses because you’ll only record the expenses once the employee is paid in July.

These types of expenses are estimates and may differ from the final invoice amount. Free Financial Modeling Guide A Complete Guide to Financial Modeling This resource is designed to be the best free guide to financial modeling! The Financial Accounting Standards Boards has set out Generally Accepted Accounting Principles in the U.S. dictating when and how companies should accrue for certain things. For example, “Accounting for Compensated Absences” requires employers to accrue a liability for future vacation days for employees. Accruals assist accountants in identifying and monitoring potential cash flow or profitability problems and in determining and delivering an adequate remedy for such problems.

Typically, when a business acquires items or services from a vendor, they are allowed a period in which to cover the payment for those items or services. Accounts payable is a current liability because https://personal-accounting.org/ the business needs to meet this obligation before the grace period for payment ends. This period may vary, with some vendors offering as little as 15 days while others give a 90-day window for payment.

For example, when a business sells something on predetermined credit terms, the funds from the sale are considered accrued revenue. The accruals must be added via adjusting journal entries so that the financial statements report these amounts. Accounts payable is the total amount of short-term obligations or debt a company has to pay to its creditors for goods or services bought on credit. With accounts payables, the vendor’s or supplier’s invoices have been received and recorded.

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. Deferred revenue is an advance payment for products or services that are to be delivered or performed in the future. Secondly, there also is the fact that despite the absence of a disclosure in Mr. John’s trial balance, on 31 December 2019 he owes $870 to the telephone company for services accrued payable definition that have already been consumed. The trial balance will, of course, have no record of the bill, and yet it would be wrong to ignore the expense involved when preparing the year’s profit and loss account. AV – On or Before the AV Deadline YEDI After the AV Deadline Select June from the accounting period drop-down. The advantage of using the AV is that it can be scheduled to auto reverse in the next fiscal year.