What are Ascending and Descending Triangle Patterns?

Contents:

The profit target should be taken when the price covers the distance less than or equal to the breadth of the first pattern wave . A stop loss in this case might be placed at the level of the local low, marked before the resistance level breakout . As we noted in the previous section, chart patterns are merely signals as to where the price of an asset might go in the future. With all chart patterns it’s sensible to wait until the direction of the move has been established before placing your trade. A symmetrical triangle occurs when the price appears to be converging with a series of lower peaks and higher troughs.

The pattern usually comprises one big trend candlestick, followed by three corrective candles with strictly equal bodies. The candles must be arranged in the same direction of the prevailing trend and be of the same color. After the series of corrective candles is completed, the market explodes via one or two long candlesticks in the direction of the prevailing trend, indicated by the first candlestick. In the common analysis, the rising Wedge pattern is classified in the reversal patterns. This formation looks like a triangle, with a single, but very important difference. That is why the pattern can work out in either side, according to the pattern direction.

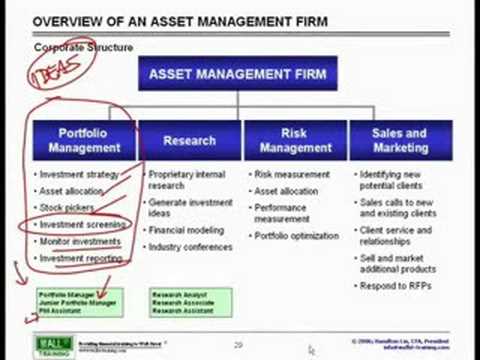

Analysts have derived summary probabilities for the expected breakout, for the average price target, and for the odds for reaching the stipulated price target for each triangle pattern. You can rest assured that experienced traders will have taken note early on in the formation process for any triangle, whether ascending descending or symmetrical. You should recognize the same pricing pattern in order to align your trading strategy with what the pros are thinking.

A move up isn’t quite as high as the last move up, and a move down doesn’t quite reach as low as the last move down. The price moves are creating lower swing highs and lower swing lows. However, if you are looking for an entry point to open a position after the symmetrical triangle pattern is formed.

Example Ascending Triangle and How to trades

When the prior trend is bullish, it indicates a higher probability of the breakout to occur on the upside of the pattern, signaling you to long the trade. A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. In an ascending triangle pattern, the upward-sloping lower trendline indicates support, while the horizontal upper bound of the triangle represents resistance.

You may open a sell position when the price, having broken through the neckline, reaches or goes lower than the low, preceding the neckline breakout . Target profit can be put at the distance that is less than or equal to the height of the middle peak of the formation . You may put a stop loss around the level of the local high, preceding the neckline breakout, or at the level of the right shoulder . In classical technical analysis, the Triple Top is classified as a reversal chart pattern. It means the trend, ongoing before the formation starts emerging, is about to reverse after the pattern is complete. There is theGBPUSD currency pair Forex chart that represents quite a seldom formation that is, in my opinion, is one of the most efficient raw price action patterns of technical indicator analysis.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

In this particular example, we see that the triangle pattern forex action returned higher to retest the supporting trend line after the breakdown. In the end, both options were on the table for us to choose from. In order to be sure that we have the opportunity to capitalize on the breakout, we decided to enter into the market once the H4 candle closed below the triangle’s supporting line . Secondly, you can opt to wait for the price action to break the triangle and then return to retest the broken trend line. This option gives you a better entry as you can use the opportunity to enter the trade exactly at the retest. On the other hand, its limitation lies in the fact that you may never get the opportunity to enter a trade as the retest isn’t guaranteed to happen.

support@m30signal.com

To determine a profit target, it can be useful to start at the breakout point and then add or subtract the height of the triangle at its thickest point. The triangle chart pattern is formed by drawing two converging trendlines as price temporarily moves in a sideways direction. The bullish pennant is a technical indicator that signals a continued uptrend in a bullish market. It is an ascending Triangle Pattern that is formed initially with a price increase in an uptrend.

If the price does break out to the upside the same target method can be used as the breakout method discussed above. Because of the lower entry point, the trader who anticipates stands to make much more than the trader who waited for the breakout. For instance, suppose a triangle forms and a trader believes that the price will eventually break out to the upside. In this case, they can buy near triangle support , instead of waiting for the breakout. This creates a lower entry point for the trade; by purchasing near the bottom of the triangle the trader also gets a much better price.

Are stocks back in a bull market?

There are three primary versions of the triangle pattern, which may commonly be found in the forex market. Traders gain a deeper understanding of future price movement and the likelihood of a continuation of the trend by analyzing these patterns. However, not all triangle patterns may be understood in the same manner, which is why it is vital to have an in-depth understanding of each triangle shape in its own right.

In the example image above there is a breakout in the direction of the high-level slope line so that the buy stop order is executed. Then it is better to do so after the breakout point appears or it can also be with a pending buy stop and sell stop pending strategies. In this case, the buyer and seller are in a consolidation time where the buyer buys at a higher price and the seller sells at a lower price. In this pattern, we also cannot determine the direction of the breakout with certainty, but believe a breakout will occur.

S&P500 Technical Analysis – ForexLive

S&P500 Technical Analysis.

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

Enter when the candle closes outside of the triangle in a so-called “breakout on a close”. Place a buy order just above the sloping upper line and a sell order just below the up sloping line. There, now you can reach for the cappuccino, shut your eyes and imagine laughing to the bank. The stairs of the pattern are often the local Flags; so you can trade them within the global Three Stair Steps pattern. The formation is a rather rare proprietary pattern, but it often works out successfully. The pattern looks like Three Crows pattern, I’ve already described, but inverted.

The first and the most efficient scheme appeared exactly in the stock market on the only then existing time frame – the daily chart. Even now, when intraday trading is growing more popular, it’s on bigger time frames that patterns prove to be the most efficient. Applying common rules to a specific pattern would be a mistake that hides a significant risk and may cause to losing money rapidly. A stop loss in this case may be put at the distance, equal to the length of any cube’s candlestick, in the opposite direction of your entry . In common technical analysis, the Spike is referred to as a type of the reversal patterns.

BTC/USD Forex Signal: Another Bullish Breakout Likely – DailyForex.com

BTC/USD Forex Signal: Another Bullish Breakout Likely.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

Please note, Australian residents cannot open an account with ACY Capital Australia Limited. The Bollinger bands can help identify overbought and oversold market conditions, protecting you against placing any orders that could lead to losses. Heikin Ashi Candlestick PatternThe Heikin Ashi Candlestick pattern is almost the same as the traditional candlesticks, with one big difference—the former is an averaged out version of the latter. Find out which account type suits your trading style and create account in under 5 minutes.

This triangle is determined on the chart with help of slanting lines drawn along the highs and lows of the movement which is tending toward the center. The top line in descending triangle pattern shall go through at least two local highs, and each subsequent high has to be lower than the previous one. If you are new to trading, you can also use built-in tools found in a lot of charting software that can easily help you identify triangles.

12 Trading with Triangle Chart Patterns

In the example above there is a breakout in the direction of the low-level slope line and the sell stop order is executed. Just like before, the target level or take profit in pip is determined by the height of the triangle . At first, buyers in the market may fail to break the upper trend line and need time to try to break through that level, before finally being able to form a new high level. The bottom trend line in the picture above follows support levels that continue to rise. In the chart, the bottom line on the triangle pattern forex represents support, while the upper line of the triangle pattern forex represents overbought. You can start trading a wedge or a triangle while it is being formed.

Next, we will deal with the three most common Forex chart patterns that will never lose their relevance and will suit both beginners and advanced traders. Like other chart patterns, ascending triangles indicate the psychology of the market participants underlying the price action. In this case, buyers repeatedly drive the price higher until it reaches the horizontal line at the top of the ascending triangle. The horizontal line represents a level of resistance—the point where sellers step in to return the price to lower levels. If you spot a triangle pattern on your chart, the general advice is to wait until the price breaks out and forms a new trend. When it happens, you can enter a trade at the breakout point and move in the direction in which the price is moving.

It is a reversal pattern in a Downtrend, where market creates exactly two bottoms on the same price level. It is a reversal pattern in an Uptrend, where market creates exactly two tops on the same price level. After a breakout, the distance of the first wave inside the rectangle should be your minimum take profit target. After a breakout, the distance of the first wave inside the pennant should be your minimum take profit target. If the pennant is formed, the minimum take profit target should be the number of pips moved in the first wave of the pennant as shown in the chart picture. Pennants could be bearish or bullish depending on the trend direction.

As you can guess by now, a descending triangle pattern is just like the opposite of an ascending triangle pattern. It is made out of a horizontal line at the bottom end of the price action and a descending trend line. A descending triangle pattern is usually considered to be a bearish trend continuation pattern formed during a prolonged downtrend. The way to trade a descending triangle pattern is you wait for the lower support level to break.

As the higher https://g-markets.net/ are characteristic of the bullish price movements, the buyers are in control, with each low printed at a higher level. Most traders love continuation figures like the triangle pattern; this makes it one of the most commonly traded chart formations in Forex. Unlike reversal patterns that signal an impending change in the trend direction, triangles are used to make profits in trend extensions. However, unless you have ample experience trading triangles, try to refrain from applying such an aggressive strategy. In the end, just as with any other type of financial tool, utilizing triangle patterns successfully boils down to having patience and doing your research as thoroughly as possible.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)