8 Best Most Accurate Forex Gold Trading Strategy For 2023

Contents

This is achieved by opening and closing multiple positions throughout the day. This can be done manually or via an algorithm which uses predefined guidelines as to when/where to enter and exit positions. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher.

- Now, the number one reason why there is no Holy Grail in trading is because there is no strategy to be profitable in every type of trading environment.

- As such, you should always read the terms before you accept the bonus or promotional offers.

- Once you have done your homework on forex pairs, pips, and order types – it’s then time to start trading.

- Usually, the average duration of the dollar-cost averaging forex strategy is several months.

- Likewise, the end of the uptrend was confirmed in August 2008 as the 20EMA crossed the 55SMA from above signaling price is now in a downtrend.

Within price action, there is range, trend, day, scalping, swing and position trading. These strategies adhere to different forms of trading requirements which will be outlined in detail below. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose from. The Renko Charts Trading Strategy is based on the Renko charts, which is an unorthodox type to plot the price action because it doesn’t factor in the time element. In order to better time the market the Renko Charts Trading Strategy uses the Ichimoku indicator as well which can offer us some killer setups. The 5 min Forex Scalping Strategy with Parabolic SAR and MACD is another scalping strategy that can be used by part-time traders as well as full-time traders.

#13: Bullish Engulfing Pattern Forex Trading Strategy

Lowest and highest sell prices indicated by moving trend lines. As you can see in the graph above, the places where the prices stay very high for a long time are the head and shoulders points. Finding these areas and drawing a line through them can tell you where the prices are going.

Bollinger Bands are effective when looking to make as many trades as possible. The indicator measures the highest and lowest points of a currency pair. Besides, they are effective for knowing when to avoid the market. A stop-loss can be placed 2 to 3 pips below the low point of a given swing with a long position in play.

These include the types of available apps for trading Forex, the choice of currencies in trading Forex, the spreads offered, and the potential profit. In addition, it is better if the broker you pick for trading Forex can offer minutes of price movements in the market. Together with a variety of other indicators, the availability of these features is key to obtaining low-risk https://1investing.in/ trades. A four-hour trend trading strategy represents a strategy where the best performance traders get using channels either bullish or bearish. Buying from the bottom of the rising trend or selling from the top of the bearish trend is a strategy where traders follow the main trend. In this strategy, historical prices are taken into account to build trading strategies.

Choosing the right broker is a fundamental step in the world of trading Forex. This is vital, as only trusted brokers will provide all the features and services you need for trading Forex in a safe and lucrative way. Of course, there are multiple things to consider, both for beginners and professionals. When we enter the trade based on a breakout, we must keep the next high as the take profit level. Before setting the Take Profit, it is important to set our stop loss. We fix our stop loss at the high +5 pips of the candle, we enter the trade.

It is best fitted for traders who can afford only a few hours of market analysis per day. After you have successfully identified a prospective range, buy near the support levels or buy near the resistance level. We recommend using oscillators like the Relative Strength Index and Commodity Channel Index to get a better sense of when to enter or exit a trade.

Multiple Time Frame Analysis Strategy

A good understanding of technical as well as fundamental analysis is required. It involves exchanging the interest, sometimes principal, of one currency with another. Because of lax legal policies, companies overseas can use it to get round limitation. These are limitations that government imposes on the buying or selling of currencies.

Opening a trade before researching the market is not what you want to do. The prices of different currencies might depend on completely unrelated factors because they are governed by different banks, institutions, and market conditions. Your goal is 50 pips and the stop-loss order is usually set somewhere between 5-10 pips—that’s under or above the 7 a.m. After you’ve set everything up, it’s time to relax and let price changes take care of the rest. If the answer to all these is yes, you usually have a steady upward trend on your hands and you can exploit it. However, never get too excited with forex—no one can truly predict what’s going to happen in the markets, so it’s best to play it safe.

To put it very simply, you cannot become a successful trader if you get carried away by your emotions. You must remain calm and collected irrespective of your trading results. You may choose the best trading strategy, but if you want it to really work, you should also choose the best online Forex trading platform. These are strategies based on analysis of market fundamentals, which include financial growth, changes in financial policies, rates of inflation, interest, and poverty, and so on.

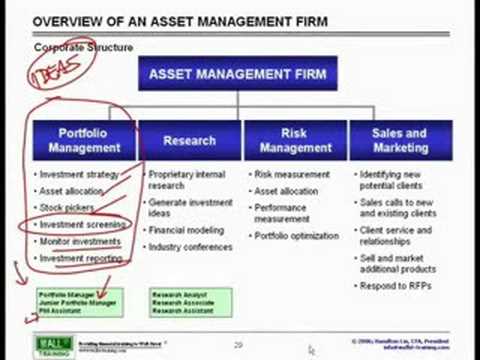

The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. As a trader, you have to be prepared to face all types of market conditions and you need to be equipped with the “right” strategy for the “right” market environment. Having a strategy that suits your personality and you understand the logic behind it, is the first step towards Forex trading profitability. The Forex market isn’t the most regulated machine in the world and scam brokers, investment advisors, and other schemes pop up every day. This goes double for the time we live in—fraudsters have become creative in the COVID-19 era and thousands of unsuspecting traders have fallen for never before seen tricks. These are training accounts you can use to practice trading with virtual money instead of real cash.

Forex Range Trading Strategy

GMT, after the candlestick closes, traders enter two opposite positions with pending orders. When one order gets triggered by a price movement, the other one gets canceled automatically. Because swing trading is a short-term strategy, traders only need to focus on price analysis rather than long-term macroeconomic trends and important global developments. This makes swing trading simpler but also relatively risky since price changes are always more hectic on a day-to-day basis. Because the grid is dynamic, this forex strategy works well in both trending and ranging markets. It quickly eliminates most spikes from news or other one-time sources.

When you see a strong trend in the market, trade it in the direction of the trend. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. The first thing you need to check is whether the brokerage you’re with is well-regulated. If it’s under the watchful eye of the main financial authorities in its country, that’s a good sign. However, brokers often won’t tell you everything you need to know and this is where problems arise. Here are a few tips on how to prepare yourself if you’re new to the trading game.

Minute Forex Scalping Strategy with CCI and Slope Indicator

If you really like to use a particular indicator, by all means use it. However, you should only use an indicator as an additional confluence to price action trading. This is much more conducive for beginners – as you can take your time researching the markets and thus – you can avoid having to make quick and instant decisions. In terms of forex swing trading strategies, a good starting point is to focus exclusively on financial news. You might be under the impression that most currency speculators are day traders – meaning that they open and close positions within a few hours or even minutes. However, some of the most successful currency traders actually prefer to take a swing trading strategy.

Fundamental Forex Trading Strategies

The interest rate component will be unchanged despite the trend since the trader will receive the interest rate differential. In this strategy, the focus rests on taking advantage of the range and the trending markets. Simply by choosing tops and bottoms, the trader can make an entry into the long as well as short positions. This is a strategy specially made for trading financial instruments within a single trading day. Under this strategy, there is a closure of all the positions before the close of the market.

Profitable Gold Trading Strategy PDF

What makes up for the small profits is the sheer number of trades opened and closed. A few pips here and there may add up to a significant amount in the end. Reversals are observed with the help of the candlestick patterns. Usually, a bearish engulfing, an evening star, or a hanging man pattern is looked up to identify rejection from the top.

It is additionally used to distinguish the specific purchase and sell signals in the market pattern. It utilizes an alternate technique that enables the traders in exact estimations of the instability, to value activity, market patterns, reversals, and backing and obstruction levels. This blend is additionally used to distinguish the intermingling and the difference in the market pattern.

Although many brokerages are shady and scammy, this isn’t true for the real top forex brokers of the world. Forex is traded in an over-the-counter market —this is a system of banks that hold copious amounts of currencies and sells them to traders directly. Since banks have huge appetites, this means you can always find a buyer and seller for any sensible trade you wish to make.

That’s why it’s imperative that you become extremely familiar with major Price Levels and how to properly trade them. You can’t just slap on random indicators and take reckless trades without any consideration of Price Levels. The key to truly understanding the daily market direction better is the concept of Price Levels. This example uses a stochastic oscillator, moving average, and the ATR indicator to determine a complete swing trading strategy. We can observe how traders tend to enter long positions when there is an uptrend considering the philosophy of buying low and selling high.

Usually, low volatility pairs are perfect for any range trading strategy such as EURGBP, EURCHF, etc. The best four-hour forex strategy is the breakout system when the RSI trendline is broken, and increased volume and economic news follow the current breakout. Usually, 4h time frame strategy is perfect for swing traders where the average trade duration is from several hours to a What are sanctions in sociology few days. Forex trading investment plans usually imply long-term position trades where traders plan to invest in some currency and hold trades for several weeks or months. This type of trade means that you are buying and selling gold many times in the forex market. It enables the traders to use and get profit more frequently and again and again by entering and exiting the trade.

Leave a Reply

Want to join the discussion?Feel free to contribute!