Investors Should Be Prepared For A 50 Fall In Shares Warren Buffet

Contents:

But, the value-investor began adding to his Occidental holdings in the first quarter of 2022 after reading through the oil major’s annual report, thereby gaining confidence in the company’s leadership and growth story. He says that the first rule is that the company should have a good income on the amount invested in the business. Second, the management of the company should be in the hands of honest and skilled managers. Investments in securities market are subject to market risk, read all the related documents carefully before investing.

In 2008, at the peak point of the global game principle ii: dominant strategies crisis, the legendary investor invested $5 billion in Goldman Sachs to strengthen the firm’s capitalisation and liquidy in turbulent times. The price-earnings ratio is a company’s share price to the company’s Earnings per Share. The ratio is used for evaluating companies and to find out whether they are overvalued or undervalued. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services.

The Buffett test: This one chart shows how much every Club holding spends on stock buybacks

It accounts for 1/3rd of the Russell 3000, comprising the 3,000 largest publicly traded corporations in the United States by market capitalization. For all those, who are worried about too much cash in the books of Berkshire Hathaway, here is a quick test. Check out how much wealth Berkshire Hathaway has created for its shareholders since inception and compare with what the S&P 500 has generated. The results will not just surprise, but are bound to astonish you. If there is ever a tome to the power of active investing, it is here. The business magnate has always said people should not buy stocks unless they expect to hold them for a long time, and Oxy checks most of Buffett’s investment boxes — financial fortitude and growing dividends.

Investing in mutual funds for your child’s education is always advisable. First of all, it is a less stressful option than investing in direct equity stocks because that requires you to have in-depth knowledge of market trends and fluctuations. Secondly, with mutual funds, there are a variety of schemes you can opt for depending on a range of factors. These factors could include the time period for which you can invest before liquidating, the amount of money you can invest, the amount you require to secure the education fund, the level of risk you can take, and so on. When it comes to building an education fund, here are the top 5 types of mutual funds you can choose from. Large-cap mutual funds The defining characteristic of large-cap equity funds is the fact that these funds invest in the top 100 Indian companies that have the highest market value.

Start Investing Now!

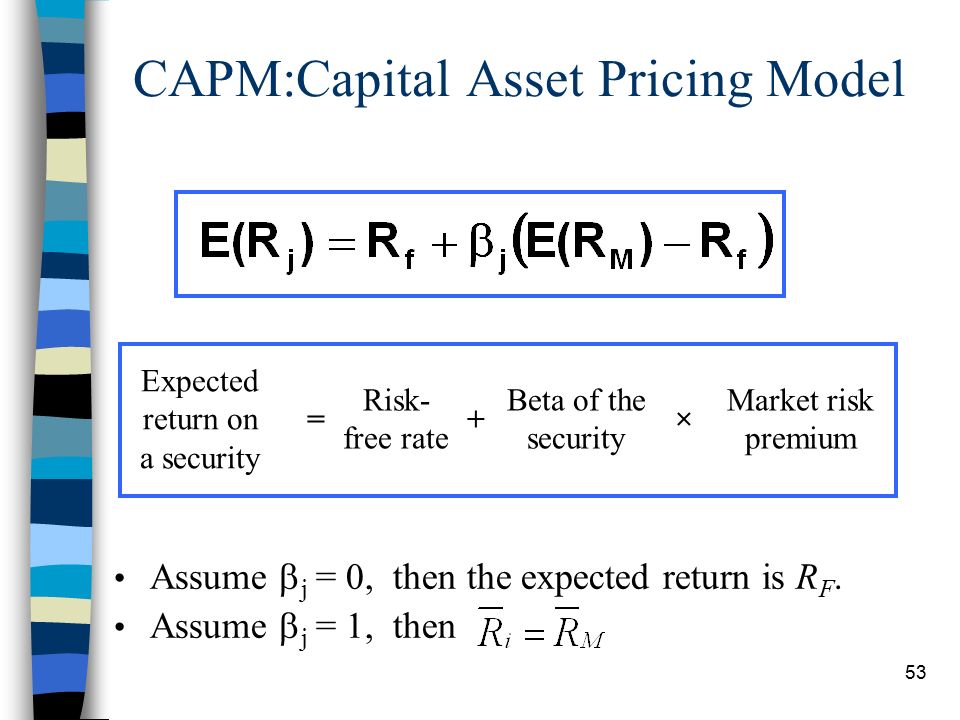

For instance, if a stock’s estimated value is $80 per share, then a purchase at $60 allows an investor to be wrong by 25% but still achieve a satisfactory result. The $20 difference between estimated fair value and purchase price is what Graham called the margin of safety. Buffett considers this margin-of-safety principle to be the cornerstone of investment success. This discounted cash-flow valuation method was described by John Burr Williams in his 1938 book, The Theory of Investment Value. It is used by countless investment professionals, so Buffett’s approach to valuation is not a competitive advantage. However, his ability to estimate future cash flows more accurately than other investors is an advantage.

Berkshire’s thirteen-F submitting discloses the present portfolio for the corporate. The following are some key stocks in Buffet’s Berkshire portfolio. More than 20 years ago, the company was content with its extremely valued, single class of inventory.

“There have been 4 great stock market buying opportunities in my lifetime. Shares bought at these prices will prove to be quite rewarding over the next few years, and perhaps a lot sooner. If you missed the other 4 great buying opportunities, the 5th one is now front and center” Bill Miller advised. The firm will also be responsible for leveraging its network and attracting business service delegations to invest in the project. Berkshire Hathaway reported first-quarter earnings of $21.7 billion on Saturday, a stark contrast to last year’s first-quarter loss of $1.1 billion. The wide swing in net income is attributable to a new accounting rule which requires companies to now include changes in the market value of investment portfolios within earnings.

Mutual Funds Weekly: These money and investing tips can unlock valuable stock-market secrets

But is that this mix of wholly owned firms, blue chip https://1investing.in/ and a hand-picked choice of youthful corporations — along with huge insurance operations — enough to make Berkshire Hathaway inventory a buy? Buffett is also one of the most profitable buyers in history with his worth investing type. The significant market capitalization utilized to establish index eligibility is this breakpoint. Many stocks get exchanged at the annual reconstitution between the Russell 1000 and Russell 2000, but the market capitalization barrier is the deciding factor. The Russell 1000’s holdings are determined by ranking all of the Russell 3000’s stocks by market capitalization and determining the market cap threshold of the 1,000th stock ranking.

That being said, occa sionally one of his new picks will fall below his purchase price, and you will have the opportunity to purchase some shares at a lower price than Buffett himself paid. You could also just buy a basket of these st ocks that Buffett owns. Buy the basket of stocks, and then sell a stock only when you hear that Buffett has exited the position. During the technology stock mania of 1999, Berkshire’s return badly trailed the market’s return, and a number of observers commented that Buffett was hopelessly behind the times for eschewing technology stocks. However, Buffett has written that he isn’t bothered when he misses out on big returns in areas he doesn’t understand, because investors can do very well by simply avoiding big mistakes. He believes that what counts most for investors is not so much what they know but how realistically they can define what they don’t know.

The meeting ultimately led the Treasury to inject $250 billion into the banking system, drawing funds from TARP. But former US President George W Bush said “The intervention, I think, probably saved a depression”. The legendary investor’s portfolio will be unveiled today with some fresh holdings expected. Yes, you can purchase fractional shares of Berkshire Hathaway Inc.

Warren Buffett is widely regarded as the world’s most successful investor, and it is no mistake we have repeatedly echoed his wisdom throughout this Investing Classroom series. The book value of his company, Berkshire Hathaway BRK.B, compounded at 21.9% per year between 1965 and 2004. That is more than double the 10.4% pretax return to the S&P 500 over the same period. According to Forbes, Buffett is the world’s second-richest man with a net worth of about $44 billion at this writing.

- In 2008, at the peak point of the global financial crisis, the legendary investor invested $5 billion in Goldman Sachs to strengthen the firm’s capitalisation and liquidy in turbulent times.

- As of June 2020,General Motors had a stock price of under $30, but the company has a long and storied history.

- Once Buffett has decided that he is competent to evaluate a company, that the company has sustainable advantages, and that it is run by commendable managers, then he still has to decide whether or not to buy it.

- Warren Buffett’s Letter to Berkshire Shareholders for last year was released on February 26, 2022.

- Nobody matches the eloquence of Buffett when he says, “Even in the past, such huge cash positions have been unpleasant, but never permanent”.

Though crude prices have whipsawed this year — from hitting $120/bbl in early June to dropping to $86/bbl recently — they are still around 13% higher for the year, making the sector one of the few bright spots in the market this year. Following Russia’s invasion of Ukraine earlier this year, energy prices have soared. That trend was bad news for consumers, but an opportunity for energy sector profits.

Vice chairman of Berkshire Hathaway, who is 99 years old, wrote an opinion piece for the Wall Street Journal in which he demanded that the US outlaw cryptocurrency completely. Throughout the past year, Berkshire has decreased its ownership of BYD. Munger, a vocal opponent of bitcoin and other cryptocurrencies, maintained his criticism of them on Wednesday, repeatedly referring to cryptocurrency as a four-letter expletive for dung. Munger, a vocal opponent of bitcoin and other cryptocurrencies, maintained his criticism.

Is Berkshire Hathaway Stock a Buy? – The Motley Fool

Is Berkshire Hathaway Stock a Buy?.

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

Now amidst the ongoing volatility in the stock market, he has asked to be prepared for a fall of up to 50 per cent in the shares. Berkshire Hathaway, Inc. is a publicly owned investment manager. Through its subsidiaries, the firm primarily engages in the insurance and reinsurance of property and casualty risks business.

Large-cap mutual funds can bring in impressive returns if you remain invested for a long period. If you are a person who wants to avoid taking very high risks with your investments and has decided on investing early for your child’s education, this is the way to go. The average returns rate has historically beaten that of Fixed Deposits and similar investment alternatives. Mid-cap mutual funds Mid-cap funds invest in Indian companies that come in the next best 250 in terms of market value. These funds are for you if you are ready to take on a higher level of risk. One way to satiate the risk appetite of mid-cap equity funds is to let them season for at least 7-10 years.

A company’s stock price typically drops when investors shun it because of bad news, so a buyer of cheap securities is constantly swimming against the tide of popular sentiment. Even investments that generate excellent long-term returns can perform poorly for years. In fact, Buffett wrote an article in 1979 explaining that stocks were undervalued, yet the undervaluation only worsened for another three years. Most investors find it difficult to buy when it seems that everyone is selling, and difficult to remain steadfast when returns are poor for several consecutive years. Although Buffett believes the market is frequently wrong about the fair value of stocks, he doesn’t believe himself to be infallible. If he estimates a company’s fair value at $80 per share, and the company’s stock sells for $77, he will refrain from buying despite the apparent undervaluation.

Leave a Reply

Want to join the discussion?Feel free to contribute!